Introduction:

Life is full of unexpected twists and turns, and sometimes, despite our best intentions, we find ourselves behind schedule—especially when it comes to filing taxes. Whether due to unforeseen circumstances, procrastination, or sheer oversight, filing taxes after the deadline doesn’t need to be a daunting task. In this comprehensive guide, we’ll walk you through the steps and considerations when you’re late to the game in filing your taxes.

Understanding the Consequences:

1. Late Filing Penalties:

The IRS imposes penalties for late filing. These penalties can accrue based on the amount you owe and how late your filing is. It’s essential to file as soon as possible to minimize these penalties.

2. Interest on Unpaid Taxes:

If you owe taxes and don’t pay by the deadline, interest starts accruing. While interest rates are relatively low, it’s still in your best interest to settle your tax bill promptly to avoid accumulating additional costs.

3. Loss of Refund Opportunities:

Filing late may result in the loss of potential refunds. The IRS generally allows a three-year window to claim a refund. Filing beyond this timeframe means forfeiting any refunds owed to you.

Steps to Take When Filing Late:

1. Gather Necessary Documents:

Collect all the required documents, including W-2s, 1099s, and any other relevant financial information. Ensure you have accurate records to facilitate a smooth filing process.

2. Use IRS Free File or E-Filing Services:

The IRS provides Free File options for eligible taxpayers with an adjusted gross income below a certain threshold. Alternatively, consider using e-filing services to expedite the process and minimize errors.

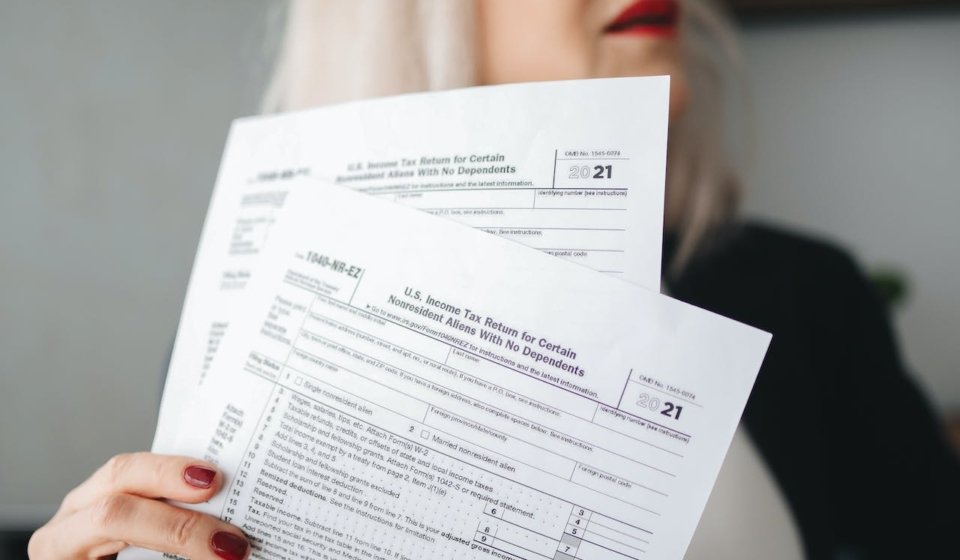

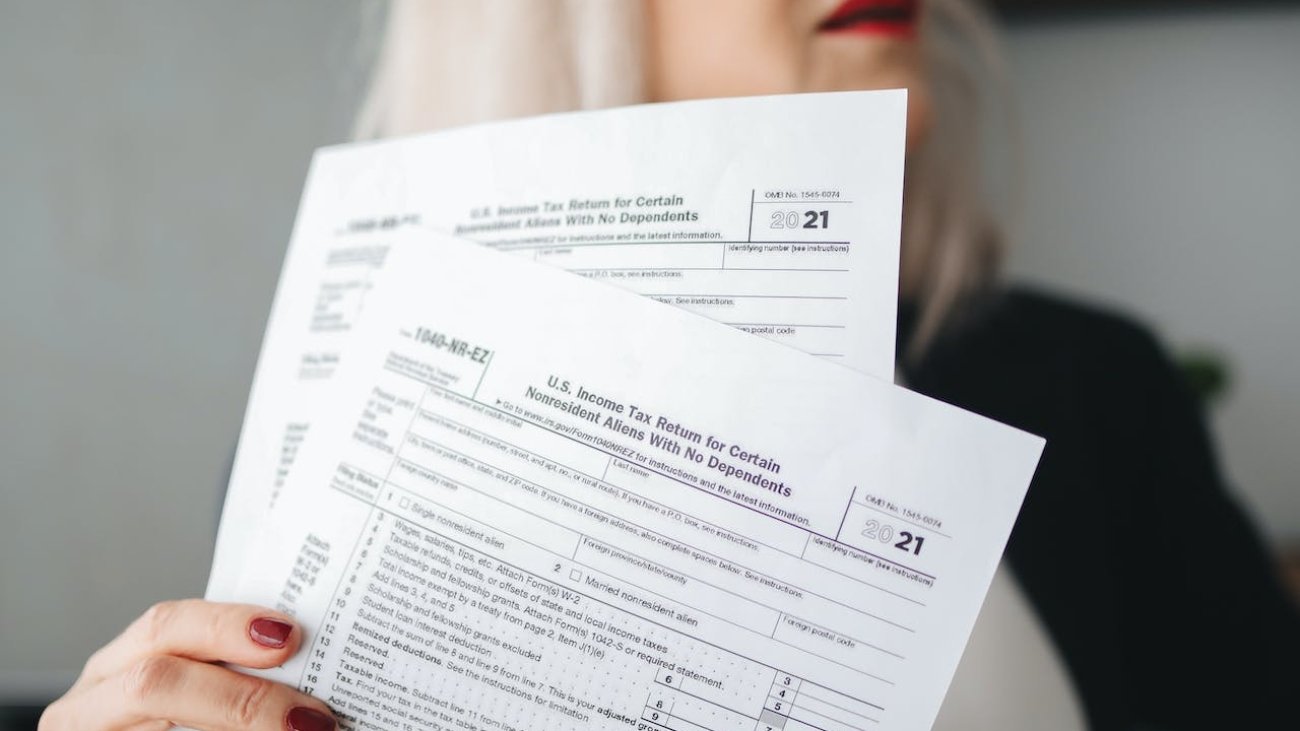

3. Understand Late Filing Procedures:

When filing late, it’s crucial to understand the specific procedures and requirements. Attach a statement explaining why you’re filing late, and be transparent about any circumstances that contributed to the delay.

4. Estimate Your Tax Liability:

If you’re unable to obtain all your financial documents promptly, make a reasonable estimate of your income, deductions, and credits. This helps you initiate the filing process while awaiting any outstanding documents.

5. Consider Requesting a Filing Extension:

If your delay is due to extenuating circumstances, consider filing for an extension. While this grants you additional time to file, remember that it doesn’t extend the deadline for paying any taxes owed.

6. Prioritize State Taxes:

Don’t forget about state taxes. Each state has its own set of rules and deadlines, so be sure to check the specific requirements for the state in which you reside.

Navigating Special Circumstances:

1. Military Service:

If you’re serving in the military, you may be eligible for special considerations regarding filing deadlines. Familiarize yourself with the available extensions and benefits for military personnel.

2. Natural Disasters:

Victims of natural disasters may qualify for filing extensions. Check if your area has been designated for special considerations due to a natural disaster.

3. Financial Hardship:

In cases of genuine financial hardship, the IRS may offer assistance or leniency. Reach out to the IRS or a tax professional to discuss your situation and explore potential options.

Tips to Minimize Future Late Filings:

1. Set Reminders:

Utilize digital calendars or reminder apps to set alerts for upcoming tax deadlines. Proactive planning helps you avoid the stress of last-minute filings.

2. Automate Payments:

Consider setting up automatic payments for estimated taxes throughout the year. This can prevent large tax bills and reduce the likelihood of late filings.

3. Consult a Tax Professional:

If your tax situation is complex or you’ve experienced repeated challenges with filing on time, consult a tax professional. They can provide guidance, help streamline the process, and implement strategies to prevent future delays.

Conclusion:

Filing taxes after the deadline may come with its share of challenges, but with careful planning and adherence to the necessary procedures, you can navigate the process successfully. Address any outstanding tax obligations promptly to minimize penalties and interest. Moving forward, implement proactive measures to stay on top of future tax obligations, ensuring a smoother and less stressful tax-filing experience. Remember, seeking professional advice and staying informed are key elements in mitigating the impact of late filings and securing a solid financial footing.